Deeper Reasons for the Online Retail Formula However, it would be because the target group is smaller not because they’re making more money. If Apple started selling items that only 1% of the population could afford, their average LTV would be enormous probably much higher than their CAC. You should also consider that LTV is based on the average customer. And if you aren’t spending enough, your competitors will. However, if your LTV is way higher than your CAC, it could indicate that you aren’t spending enough on your customers. A ratio of 1:6+ is even better.“ 1:6 and up means your customer loyalty program is working brilliantly, your customer experience is near perfect, and overall you’ve honed and optimized your site just right. “The ideal CAC:LTV ratio is different for every industry, but the comfortable range is between 1:3 and 1:5. On the opposite end of that, you might find out that your CAC is too much lower than your LTV, meaning you aren’t spending enough on your customers. Once you start looking into how large and how quickly you can scale, you will want to know if, and by how much, you can increase your acquisition spending without going into the red. The larger your business grows, the more important the retail math formula becomes you won’t always be able to use rough estimates. The difference between your CAC and LTV will inform you of how you should adjust your marketing spending. The online retail formula isn’t just a matter of figuring out if your CAC is lower than your LTV. Business & Marketing Reasons for the Online Retail Formula Sure, you can have a rough idea of what you spend and what you make back without having to do the retail math, but there are tangible reasons to sit down and make this formula work for your business. Why is the Online Retail Formula Important? First, let’s discuss why you should care about this formula, then we’ll break the formula down to examine the parts. The tricky part is breaking the formula down, and using the insights you gain in an actionable way. Of course you want to pay less for your customers than you make from them. Which makes sense that’s basic retail math. Keep your Customer Acquisition Cost (CAC) below your Customer Lifetime Value (LTV). At its simplest, you want your formula to look like this: The online retail math formula describes the ratio of your Customer Acquisition Cost (CAC) to your Customer Lifetime Value (LTV).

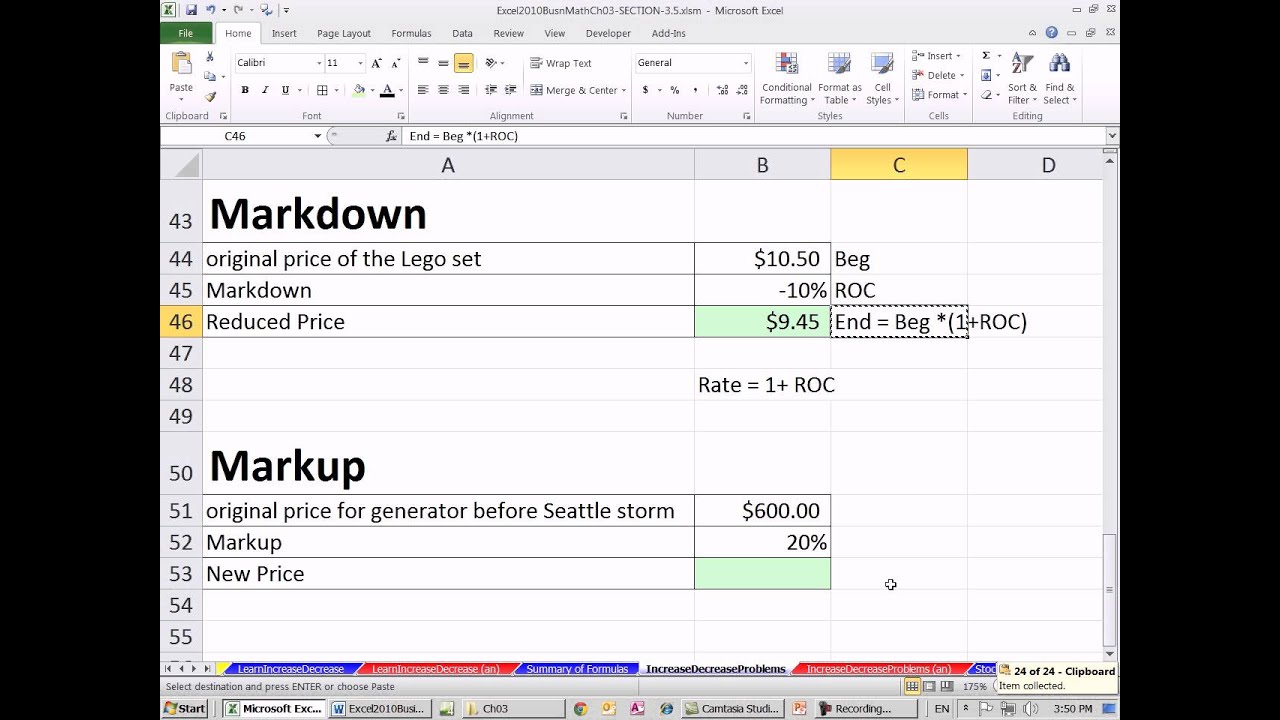

The same is true for 85% and 15% case applied to the discounted price.3. This is because 80% of the original price is the same as subtracting 20% of the original price from the original price. As an example, to more efficiently compute the discount described above:įinal price = (0.80 × 279) × 0.85 = $189.72 This equates to a 32% discount, rather than a 35% discount, and this calculation is how the calculator is intended to be used. Thus, with a 20% discount off of $279, and an additional 15% off of that discounted price, you would end up saving a total of: It is not a total of 35% off of the original price.

If you have a coupon for another 15% off, the 15% off would then be applied to the discounted price of $223.20. Using the same example, assume that the 20% discount is a discount applied by the store to the product. You would therefore be saving $55.80 on the purchase for a final price of $223.20.įor this calculator, a "stackable additional discount" means getting a further percent off of a product after a discount is applied. For example, given a product that costs $279, 20% off of that product would mean subtracting 20% of the original price from the original price. A percent off of a product means that the price of the product is reduced by that percent. A percent off of a product or service is a common discount format.

0 kommentar(er)

0 kommentar(er)